“We live in an era of fraud in America. Not just in banking, but in government, education, religion, food, even baseball.”

I watched The Big Short on recommendation from my brother, who watches approximately two to three movies/year and tends to enjoy stories about large-scale crime. I too enjoy a good heist, drug racket, etc. but Adam McKay in the director’s chair isn’t quite as inspiring as say, Scorsese or Stone. I’m by no means an Adam McKay detractor—his collaborations with Will Ferrell (which, up until The Big Short comprised the entirety of his oeuvre) are among that actor’s best works—but I like to pretend I’ve mostly outgrown my teenage sense of humor.1 But this isn’t just a run-of-the-mill adult comedy, nor is it a satire. Rather, it’s a mostly true story about the 2008 financial crisis told through the lens of the few who predicted it and subsequently made out like bandits as the world economy collapsed around them. But McKay doesn’t leave his comfort zone behind entirely. Instead, he finds a nice middle ground where he’s able to take a complex subject—one that many would simply tune out in about thirty seconds if it were brought up in conversation—and explore it in an entertaining, digestible, and unexpectedly creative manner.

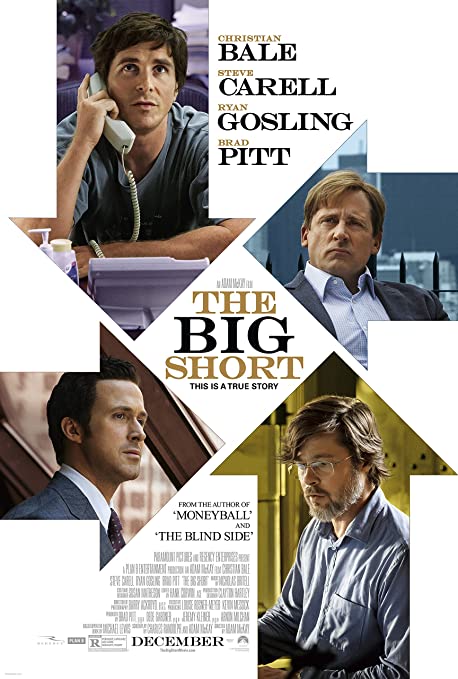

Unlike the typical con men featured in Wall Street blockbusters, for instance, your Jordan Belforts and Gordon Gekkos, the heroes of The Big Short are a bunch of ambitious nerds who actively mourn as they profit from the destruction around them. A few are portrayed by movie stars—namely Christian Bale, Steve Carell, Ryan Gosling, and Brad Pitt—but the closest we get to a suit-and-tie swindler is Gosling’s Jared Vennett, a salesman from Deutsche Bank who will stand in a conference room with a straight face and literally sniff the air because he can “smell” money. Bale portrays Michael Burry (the only character who bears the name of his real-life counterpart), a slightly autistic hedge fund manager who lost an eye to a childhood illness, graduated with an M.D. from Vanderbilt, then dropped out of the medical field to start his own investment firm named after a Terry Brooks novel and fill up message boards with his Benjamin Graham style value investing analyses. He is an eccentric fellow who will zone out when interviewing job candidates, blast heavy metal in his office, and stick to his guns when his investors unanimously question his decisions. Carell plays Mark Baum, the irascible president of a small trading firm who is nauseated with the amount of corruption in the world’s financial ecosystem and is haunted by his brother’s suicide. Pitt is more of a background figure, a reclusive former trader who left the game in disgust but is persuaded to return and lend his credentials to two youngsters (Finn Wittrock and John Magaro) to whom he preaches a hippie-survivalist message.

Based on Michael Lewis’s book of the same named (subtitled Inside the Doomsday Machine), The Big Short tells three vaguely linked stories about the research, analysis, and decision-making that transpired at Scion Capital, FrontPoint Partners, and Brownfield Capital in the months and years leading up to the financial crisis. The backroom machinations that led to the collapse are, by design, convoluted and brimming with fancy jargon, but McKay and co-writer Charles Randolph do a splendid job of teasing out and explaining the pertinent details. So if terms like shorts, predatory lending, credit-default swaps, sub-prime, collateralized debt obligations, mortgage-backed securities, the International Swaps and Derivatives Association, Standard and Poor’s, etc. would immediately turn your brain off, rest assured that McKay understands this and uses a variety of tricks to convey the subject matter in entertaining and informative ways. One of his methods is the celebrity cameo. Margot Robbie appears in a bubble bath, Anthony Bourdain in a kitchen, Richard Thaler and Selena Gomez at a poker table, each portraying themselves in non-sequitur asides to explain various key concepts. Another is the extensive use of the fourth wall break. Sometimes this is used to give context while other times it is humorously used to inform us that the screenwriters took dramatic license in a specific instance.2 He also integrates a variety of pop culture detritus, photo collages, and musical concoctions of industrial sounds to add context and flavor.

Once you’re neck deep in the personal stories and chuckling at Ryan Gosling’s voice cracking when he yells “I’m jacked to the tits!” you will eventually comprehend the sickening gravity of the film’s thesis: that the bloated banking industry deliberately created corrupt systems and financial tools that took advantage of the everyman, paid off journalists and ratings agencies to prop up their shaky loans, and created a ticking time bomb. They profited in the lead-up to the crash, proudly ripping off the impoverished and giddily brushing their morals under the rug, and when it finally came, the vast majority of them got off scot-free. The hard-earned dollars of the American taxpayer, ostensibly used to provide goods and service for the benefit of the American people, were instead used to bail out a bunch of hubristic evildoers who will happily run off a cliff Wile E. Coyote style once again because the government has removed the negative incentive. If there’s one grave oversight in The Big Short, it’s that lawmakers who incentivized banking executives to take stupid risks and participated in fraudulent collusion are never put on the hot seat.

I find it admirable that The Big Short initially plays out with an eye toward convention by getting us to cheer for these outcasts who keep claiming the sky is going to fall; but then when the moment comes and the sky is clearly falling, it points a condemning finger at the two youngsters who are set to make millions of dollars and says, “If we’re right, people lose homes. People lose jobs. People lose retirement savings, people lose pensions.” It brings the story back to reality, aiming to enlighten and infuriate as much as entertain.

1. This is very probably a willful delusion.

2. This has the added benefit of allowing subsequent fourth wall breaks to underline the verity of outrageous events like Baum interrupting a conference speaker then taking a phone call in the middle of an argument across the auditorium.